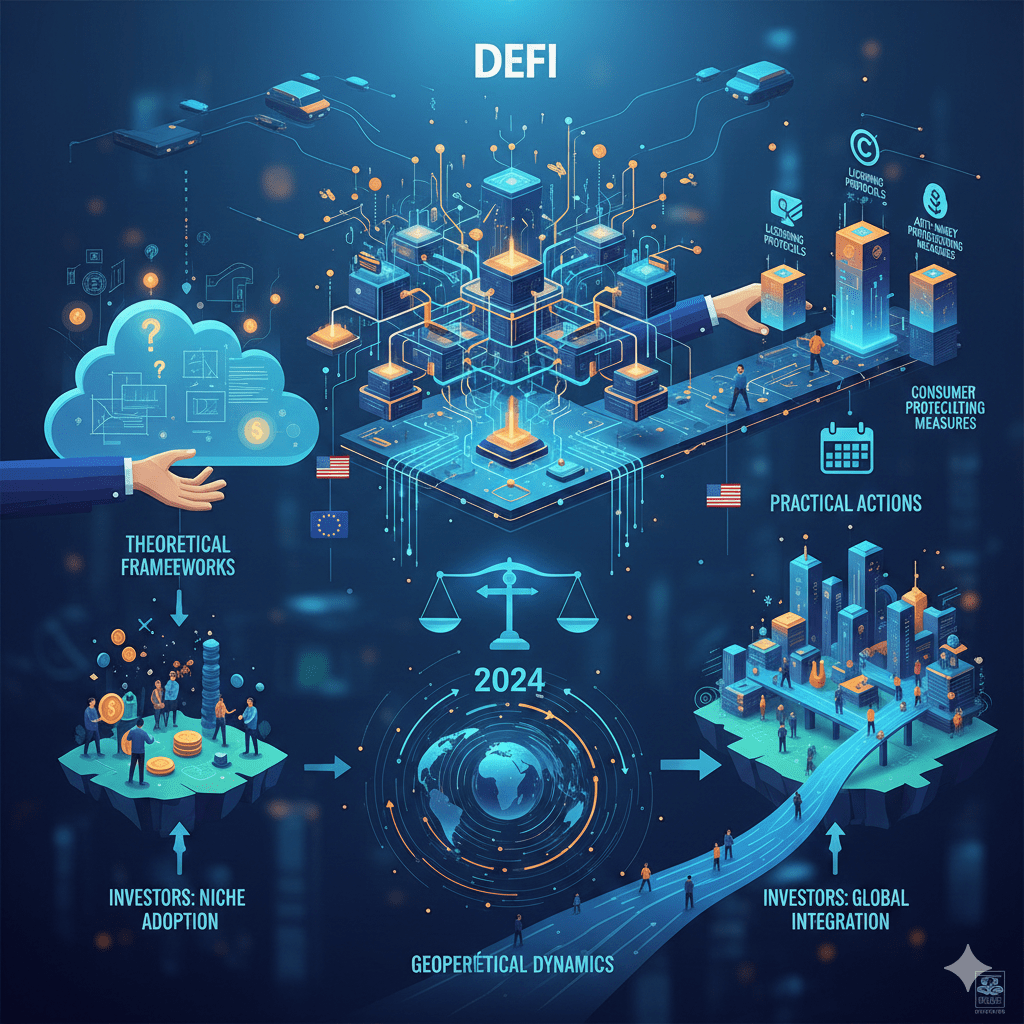

The regulation of DeFi (Decentralized Finance) has moved from the theoretical to the practical realm. In 2024, global regulators, from the SEC in the US to lawmakers in the EU, have shifted from observation to concrete action. This process will determine whether DeFi remains a niche technology for enthusiasts or becomes part of the global financial system. In this analysis, we examine the key scenarios, geopolitical dynamics, and implications for investors.

Key Takeaways

- The main challenge for regulators is how to control a decentralized and borderless system. The focus is shifting to “on/off-ramps”: exchanges and stablecoins.

- The MiCA regulation has come into force in the EU, creating the world’s first comprehensive framework for crypto-assets, which also affects DeFi.

- In the US, the SEC continues its policy of “regulation by enforcement,” treating many tokens as securities. This creates uncertainty.

- The most likely scenario is a split in the ecosystem into regulated (for institutions) and anonymous (for purists) segments.

- For investors, this means more security but less anonymity. They will have to consider KYC and jurisdictional risks.

Why Has 2024 Become a Turning Point for DeFi Regulation?

Until recently, decentralized finance developed in a regulatory vacuum. However, a series of high-profile hacks, the collapse of algorithmic stablecoins, and the use of protocols for sanctions evasion have forced authorities to act. The main dilemma: Regulating DeFi must protect consumers and financial stability without killing innovation and decentralization.

Three Unsolved Problems That Drive Regulators Crazy

- The Accountability Problem: Who to punish if there is no owning company? The smart contract developers, the DAO, the validors?

- Cross-Border Nature: A protocol is used from 50 countries simultaneously. Whose laws apply?

- Technical Complexity: Many regulators still don’t understand the differences between AMMs, staking, and restaking.

Three Scenarios for the Development of DeFi Regulation

Industry analysts identify three main paths that the regulation of decentralized finance could take in the next 2-3 years.

Scenario 1: Regulation Through Gateways (Most Realistic)

Regulators won’t interfere with the blockchain itself but will strengthen control over the points of conversion between fiat and crypto. This means:

- Strict KYC for all centralized exchanges (CEXs) and stablecoin issuers.

- Requirements for wallet providers with transaction tracking.

- Outcome: DeFi will remain a free zone, but the “entry ticket” will become regulated.

Scenario 2: Direct Regulation of Protocols and DAOs (Aggressive Scenario)

Attempts to equate Decentralized Autonomous Organizations to legal entities. This is the path taken by the SEC in the US, filing lawsuits against protocol creators. Risk: This will force developers to go completely anonymous, and investors from developed countries will lose access to promising projects.

Scenario 3: Regulatory Sandboxes and “Legitimate DeFi”

Creating special jurisdictions (UAE, Singapore, Switzerland) where projects can operate legally under supervision. This includes “emergency stop mechanisms” in smart contracts, licenses for protocols, and mandatory insurance for liquidity pools. Such DeFi will become a bridge for the entry of traditional financial institutions.

Important for Investors

Regulating DeFi does not mean banning it. It means “civilizing” the industry. In the short term, this will cause volatility and drive some projects “underground.” In the long term, it will attract trillions of dollars in institutional money, increase security, and provide legal certainty. Be prepared for mandatory verification (KYC) even in seemingly anonymous protocols.

Geopolitics: Who Will Set the Tone? (EU, US, Asia)

- European Union (MiCA): Leader in comprehensive regulation. Starting in 2024-2025, MiCA rules will become a benchmark for many countries. Focus on consumer protection and stablecoin stability.

- United States (SEC, CFTC): Aggressive stance through litigation. Creates “regulatory arbitrage” – projects flee to more friendly jurisdictions. The outcome of several key court cases in 2024 will be decisive.

- Asia (Singapore, Hong Kong, UAE): Strategy of “attract and regulate.” Clear rules to attract capital and innovation. Will become the main hubs for regulated DeFi.

Forecast for 2025-2026: What Awaits the Industry?

- Ecosystem Split. “White” (licensed, KYC) and “black” (anonymous, no rules) protocols will emerge. Most users will choose the first option.

- RegTech Boom for DeFi. A market for automated compliance solutions will emerge (e.g., counterparty screening directly in smart contracts).

- Integration with TradFi. Major banks will begin using public blockchains and DeFi protocols for settlement and cross-border payments, creating a hybrid system.

- “Crypto Winters” Will Be Milder. Regulation will reduce speculative fervor but also lessen the scale of downturns.

Conclusion

Regulating DeFi is not an apocalypse for the industry but its inevitable maturation. By 2026, we will have not one but several parallel realities: from fully regulated protocols for passive investors to anonymous tools for digital nomads. The main advice for investors is to carefully study a project’s jurisdiction and prepare for anonymity to become a paid and niche service. The final battle will not be between DeFi and the state, but between different countries for the right to write the rules for the finance of the future.